Clippings 2 ~ Changes (mostly)

Tech stocks, employment trends, Asian fixed income, a precious (metal) year, margins on the move, a sticky presidential cycle, etc.

Thanks for taking a look at this new Substack. If you’d like the occasional quick look at some important snippets from around the ecosystem, please subscribe.

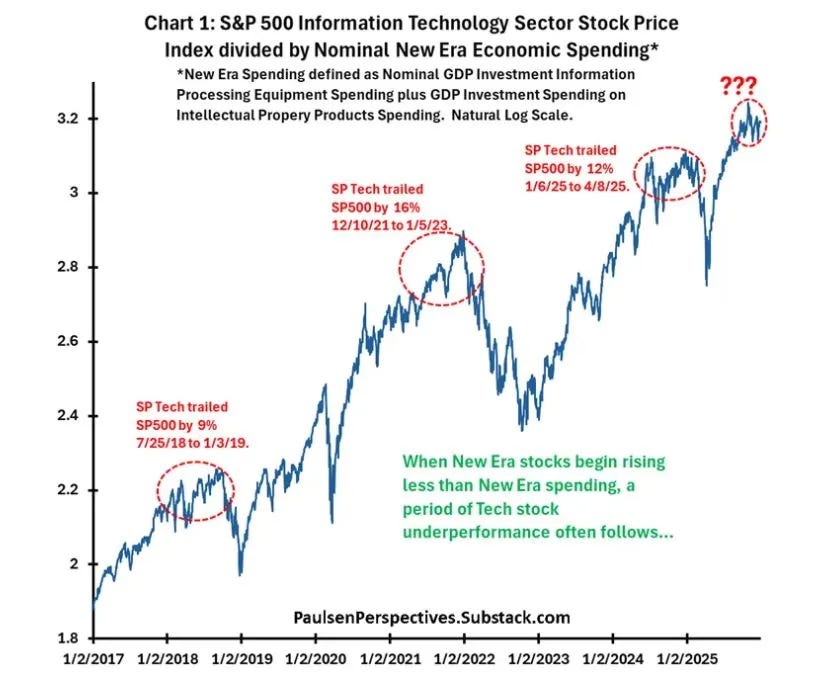

~ Jim Paulsen on “New Era” stocks versus spending, via Odd Lots (Tracy Alloway and Joe Weisenthal).

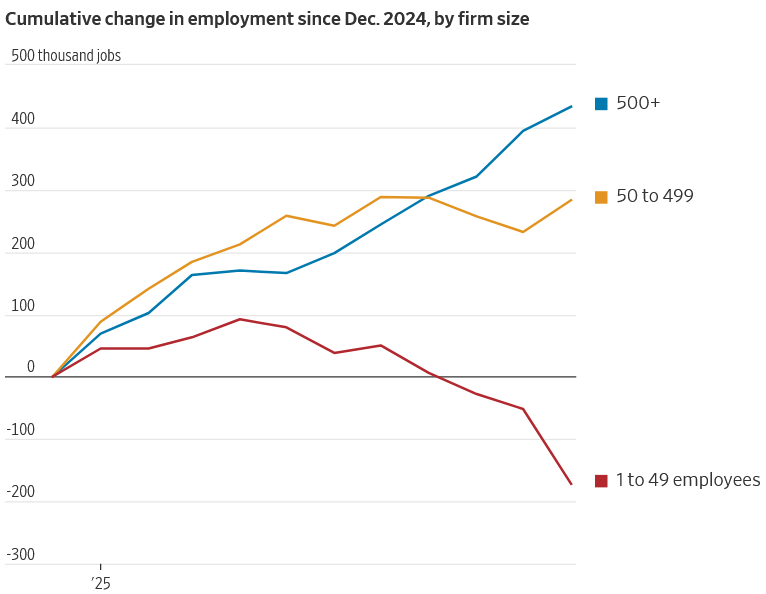

~ Small employers have been retrenching. (“The Economic Divide Between Big and Small Companies Is Growing,” Harriet Torry and Justin Lahart, Wall Street Journal.)

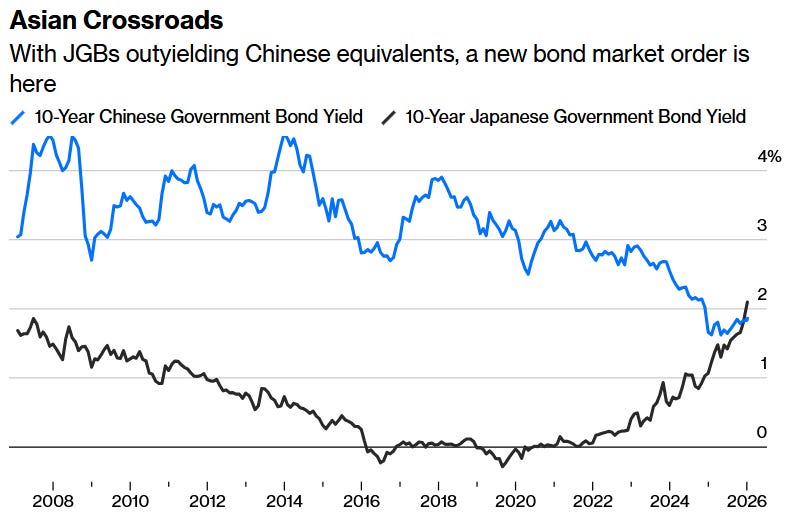

~ Significant change in the relationship between bond yields in the biggest Asian economies. (“Japan’s Bond Widows Are Finally Having Their Day,” John Authers, Bloomberg.)

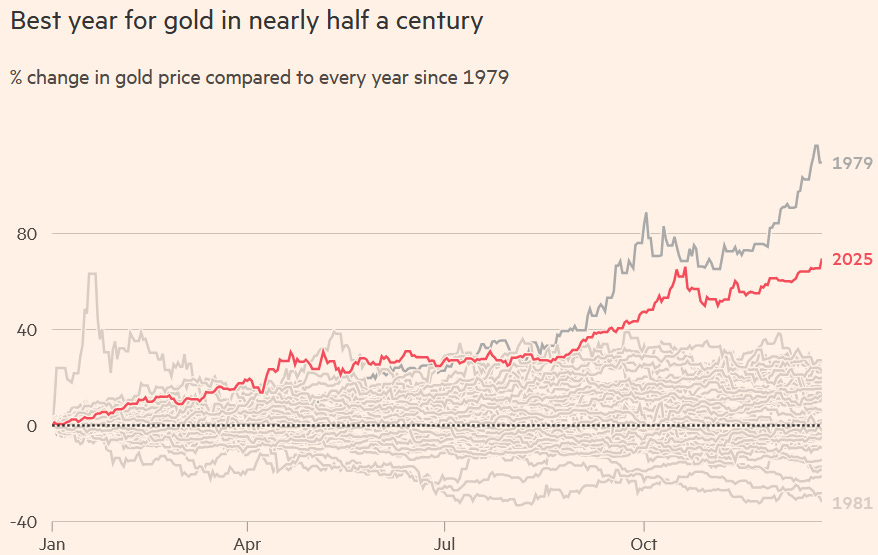

~ A golden year, one in a group of 2025 charts from the Financial Times.

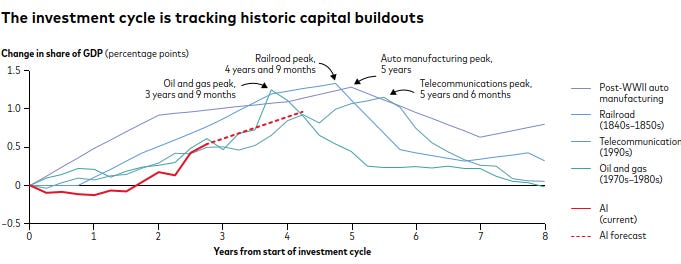

~ Comparing the AI investment cycle to previous ones (are we still early in the cycle?) — from Vanguard, “AI exuberance: Economic upside, stock market downside.”

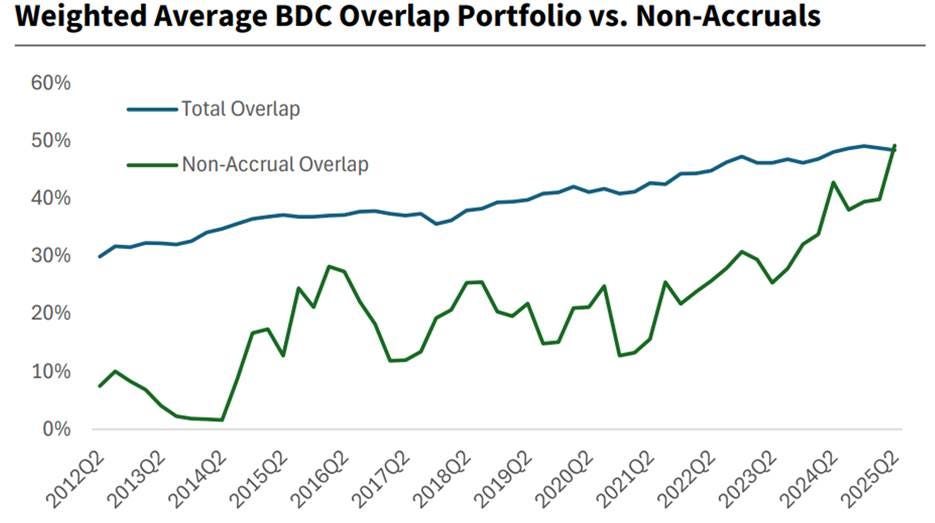

~ There’s a lot of overlap across business development company portfolios (overall and regarding non-accruals); chart from Raymond James via Larry Swedroe in “How Diverse Are BDC Portfolios?”

~ Corporate spreads are tight. (ICE BofA US Corporate Index Option-Adjusted Spread, FRED).

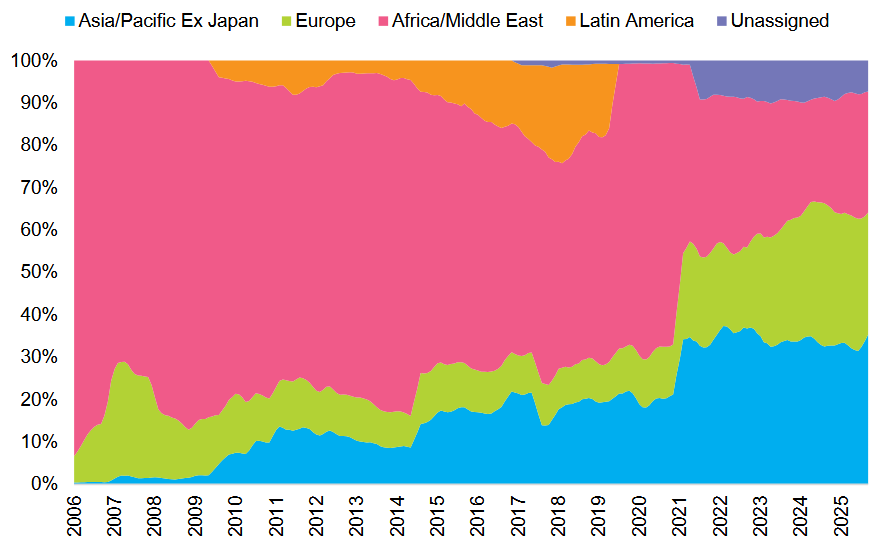

~ The geographic composition of the MSCI Frontier Markets Index has changed dramatically. (“Frontier Markets,” Braden Clark, et al., Meketa.)

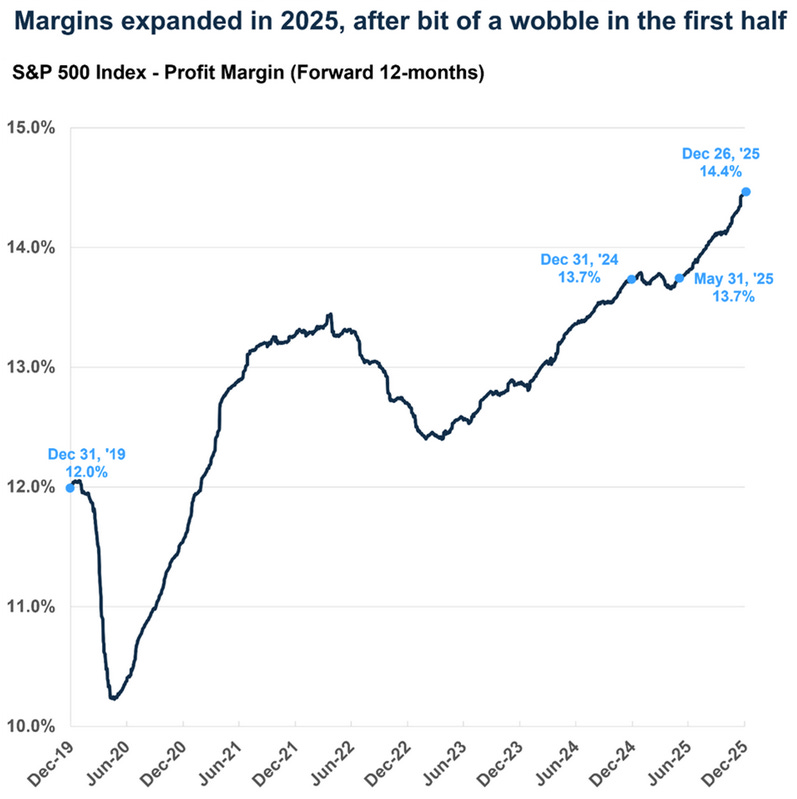

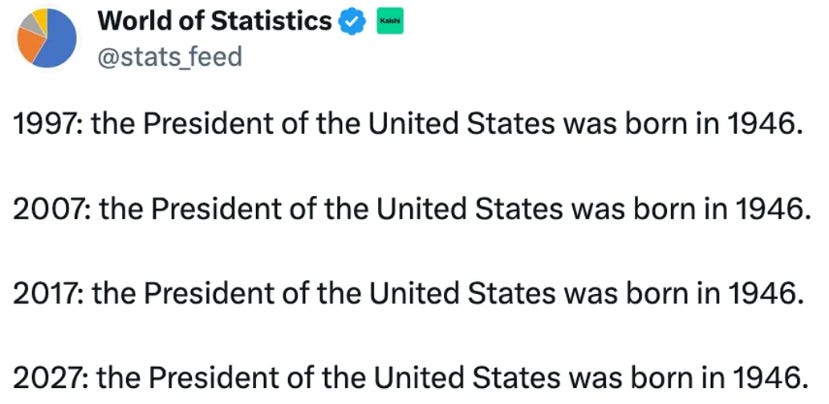

~ Margins have increased a lot this decade (Carson Group; hat tip Abnormal Returns).

Bizarre. (Via “The Return of the Weirdo,” Ted Gioia, The Honest Broker.)

The latest posting on the main Investment Ecosystem site featured sections on the Tiger Global “spray and pray” approach, the history of information markets, and two very different sides of capitalism. Plus, private credit, alternative asset managers, mission investing, good finance books, nine more current topics, and a look back at the investor Philip Fisher.

Love this. Great chart finds!